We first started hearing about this from some underground sources we have.

Now it looks like the cat is out of the bag.

Now we are not in the business of giving financial advice, but we are all taking a look at some possible strategies to stay ahead of the Feds.

February 22, 2013

The Feds Want Your Retirement Accounts

By John White

Quietly, behind the scenes, the groundwork is being laid for federal government confiscation of tax-deferred retirement accounts such as IRAs. Slowly, the cat is being let out of the bag.

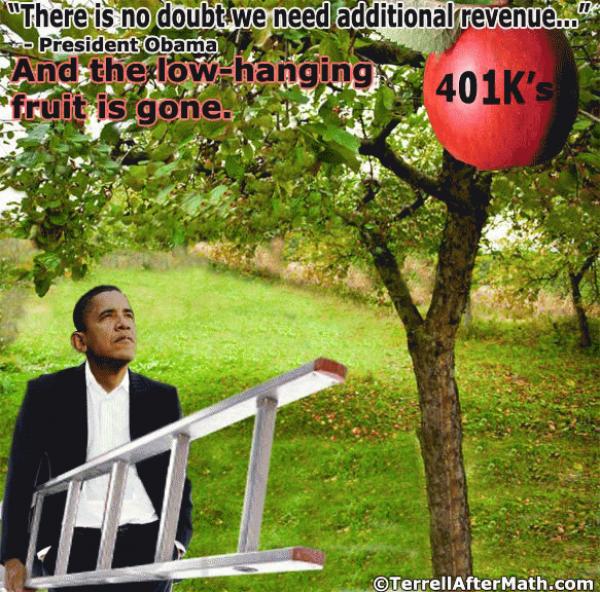

Last January 18th, in a little noticed interview of Richard Cordray, acting head of the Consumer Financial Protection Bureau, Bloomberg reported “[t]he U.S. Consumer Financial Protection Bureau [CFPB] is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings, a move that would be the agency’s first foray into consumer investments.” That thought generates some skepticism, as aptly expressed by the Richard Terrell cartoon published by American Thinker.

Last January 18th, in a little noticed interview of Richard Cordray, acting head of the Consumer Financial Protection Bureau, Bloomberg reported “[t]he U.S. Consumer Financial Protection Bureau [CFPB] is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings, a move that would be the agency’s first foray into consumer investments.” That thought generates some skepticism, as aptly expressed by the Richard Terrell cartoon published by American Thinker.

Days later On January 24th President Obama renominated Cordray as CFPB director even though his recess appointment was not due to expire until the end of 2013.

One day later, in the first significant resistance to President Obama’s concentration of presidential power, a three judge panel of the U.S. Court of Appeals in Washington DC unanimously said that Obama’s Recess Appointments to the National Labor Relations Board are unconstitutional. Similar litigation testing the Cordray appointment to the CFPB is in the pipeline.

The Consumer Financial Protection Bureau (CFPB) created by the 2,319 page Dodd-Frank legislation is a new and little known bureau with wide-ranging powers. Placed within the Federal Reserve, a corporation privately owned by member banks, the CFPB is insulated from oversight by either the President or Congress, its budget not subject to legislative control. It is not even clear that a new President can replace the CFPB director on taking office.

Unusual legal and political environments have a significant impact on the CFPB. With Cordray’s recess appointment in doubt several questions remain unanswered.

1) What will become of the CFPB when Cordray’s appointment is found invalid? An indicator comes from the NRLB, which operated unconstitutionally for years without a quorum. In 2007 the Senate threatened no NLRB nominations reported out of committee.

The NLRB continued operating with two members. Then a Supreme Court ruling in June of 2010 invalidated the NLRB decisions for lack of a quorum. Fisher & Phillips give the details about what was done next.

But recovery from the Supreme Court’s sting was quick, with Liebman and Schaumber still on the Board and with two new Members confirmed, … the suddenly full-strength Board simply added a new Member to the “rump panel” of the original decisions and managed to rubber-stamp many of the disputed Orders – at a record-setting pace – with the same result…

This may explain why President Obama renominated Cordray a year early. Once confirmed Cordray can rubber-stamp decisions made while he was unconstitutionally appointed. Otherwise those decisions will be invalidated.

2) What will the CFPB do with your money? The CFPB incursion into individual personal savings, in order to control how you invest your money, isn’t a new idea. Current proposals grew from a policy analysis as disclosed by Roger Hedgecock.

On Nov. 20, 2007, Theresa Ghilarducci, professor of economic policy analysis at the New School for Social Research in New York, presented a paper proposing that the feds eliminate the tax deferral for private retirement accounts, confiscate the balance of those accounts, give each worker a $600 annual “contribution,” assess a mandatory savings tax on every worker and guarantee a 3 percent rate of return on the newly titled “Guaranteed Retirement Accounts,” or GRAs.

How would that be accomplished? The Carolina Journal reported Ghilarducci’s 2008 testimony to Nancy Pelosi’s House.

Democrats in the U.S. House have been conducting hearings on proposals to confiscate workers’ personal retirement accounts “including 401(k)s and IRAs” and convert them to accounts managed by the Social Security Administration.

Your Government universal GRA investment savings account is an annuity managed by Social Security. Hedgecock noted ‘[m]ake no mistake here: Obama is after your retirement money. The “annuities” will “invest” not in the familiar packages of bond and stock mutual funds but in the Treasury debt!’

By 2010 Bloomberg published an article titled “US Government Takes Two More Steps Toward Nationalization of Private Retirement Account Assets.” In that article Patrick Heller observed that, with Democrat control of Congress and the Presidency:

[I]n mid-September 2010 the Departments of Labor and Treasury held hearings on the next step toward achieving Ghilarducci’s goals. The stated purpose was to require all private plans to offer retirees an option to elect an annuity. The “behind-the-scenes” purpose for this step was to get people used to the idea that the retirement assets they had accumulated would no longer be part of their estate when they died.

So the Government would get the money, not the estate or family of the people who saved the money during a lifetime of work. That’s a one hundred percent death tax on savings. Worse, the most responsible and poorest families will be penalized.

Democrats had a blueprint for diverting people’s savings from private investment to government debt. Then in 2010 the Tea Party won the house…

3) Why should the Government intervene in people’s savings decisions? The justifications for Government intervention in private financial decisions are varied. Panic over the economy, Wall Street, mandating savings equity, eliminating investment risk, financial crisis losses, retirement security, much-needed oversight, your 401K becomes a 201K, shoddy financial products, and predatory investment bankers are just a few.

If the financial industry is so predatory, how is it possible that savers keep any money? More importantly, we have all those government agencies, FDIC, FINRA, SEC, Labor Department, Treasury Department, NCUA, Office of Thrift Supervision, FHFA, NCUSIF, Comptroller of the Currency, Office of Foreign Assets Control, Pension Benefit Guaranty Corporation, hundreds of criminal penalties, and state level regulators. Are we admitting the Government is incapable of policing criminal and predatory behavior? Do we have invincible predators plundering the people, or do politicians Cry Wolf?

And about that crisis in the economy. Former Congressman Barney Frank, one of the authors of Dodd-Frank, admitted to Larry Kudlow that Government was to blame for the housing crisis.

Professor Ghilarducci said “humans often lack the foresight, discipline, and investing skills required to sustain a savings plan.” Professor Ghilarducci tells us that people are flawed, no argument there.

Her solution, substitute Government decisions for the judgment of the millions of people who actually earned and saved the money. She fails to mention the government bureaucrats wielding the power to compel you to comply are themselves imperfect. Which is preferable, one faulty Government solution or millions of individual free choices?

4) Are there other forces pushing Government to confiscate people’s savings? With $16 trillion in debt the short answer is yes. When governments embark on a path of spending money they don’t have, they resort to financial repression. According to Wikipedia:

Financial repression is any of the measures that governments employ to channel funds to themselves, that, in a deregulated market, would go elsewhere. Financial repression can be particularly effective at liquidating debt.

Do we have any evidence that the US Government is pursuing financial repression? Yes we do. Jeff Cox at CNBC. “US and European regulators are essentially forcing banks to buy up their own government’s debt-a move that could end up making the debt crisis even worse, a Citigroup analysis says.”

An Investors Business Daily article, Banks Pressured to Buy Government Debts, notes that “[b]anks can’t say no. They fear the political fallout. So they meekly submit to the government’s dictates.”

Meanwhile the Wall Street Journal reports that “[i]n 2011, the Fed purchased a stunning 61% of Treasury issuance.” Then a CNS News article revealed that “[s]o far this calendar year [2013], the Federal Reserve has bought up more U.S. government debt than the U.S. Treasury has issued.”

5) Is the health of Social Security (SS) a factor? There are several potential measures of when Social Security retirement goes broke. One measure is when FICA tax income doesn’t cover the cost of retirement checks. We have passed that point already. Others say that SS is fine until the lock box runs out of special issue bonds (IOUs).

Even though the SS bonds in the lock box cannot be sold on the open market, the Treasury Department remains under political pressure to honor that obligation by borrowing real cash to redeem the IOUs. At least until the IOUs in the lock box are gone. How long is that? Based on a credible source, Bruce Krasting at Zerohedge suggests not long.

SS consists of two different pieces. The Old Age and Survivors Insurance (OASI) and Disability Insurance (DI). Both entities have their own Trust Funds (TF). OASI has a big TF that will, in theory, allow for SS retirement benefits to be paid for another 15+ years. On the other hand, the DI fund will run completely dry during the 1stQ of 2016.

So Krasting expects the President and Congress will soon be forced to choose between 4 solutions:

1 Increase Income Taxes

2 Increase Payroll Taxes

3 Cut disability benefits by 30%

4 Kick the can down the road and raid the retirement fund to pay for disability shortfalls.

Krasting predicts Congress and Obama will be behind door number four. His credible source is the Congressional Budget Office report Social Security Trust Fund–February 2013 Baseline. In the footnotes it projects a $1 Trillion drain on the retirement fund which currently holds $2.8 Trillion. That’s a loss of approximately one third of the retirement IOUs.

Krasting however omits another possible solution, politicians can raid private retirement savings to put more IOUs in the lock boxes and more real money in the Treasury. Other people’s money is a temptation and $19.4 Trillion is a very large temptation.

Social Security is the largest entitlement program with a trust fund of $2.8 Trillion IOUs, soon to be reduced by another $1 Trillion. Can any politician, addicted to spending, resist that temptation of $19.4 Trillion? That’s real people’s real money that will be spent by Government in exchange for IOUs given to the SS lock box.

Meanwhile newly minted Senator Elizabeth Warren has entered the debate. Conservatives and Republicans have challenged the CFPB in the wake of the unconstitutional recess appointment. Bloomberg speculates that Warren might agree to trim the CFPB powers in a compromise. Bloomberg reported:

“A strong independent consumer agency is good for families and lenders that follow the rules and good for the economy as a whole,” Warren said yesterday in an interview. “I will keep fighting for that.” [snip]

Some observers have suggested that Warren’s original support for a commission-led bureau might mean she would be amenable to compromise on that issue. Warren spokesman Dan Geldon said such speculation is mistaken.

“Senator Warren thinks the single director structure makes sense and that CFPB should continue to be able to operate, like every other banking regulator, without relying on appropriations for its funding,” Geldon said.

Bloomberg also notes that soon “the Senate will have to decide whether to vote to confirm director Richard Cordray in his post, which would make a legal challenge pointless.”

Conservatives and Republicans challenge the surrender of legislative power to the bureau, the concentrated power of a single director, the unconstitutional recess appointments, and the violation of constitutional separation of powers. The Republican position is the constitutional questions and litigation presently underway should be resolved prior to approving a director of CFPB.

The constitutional issues surrounding Dodd — Frank and the CFPB are beyond the space for this article. For those interested in the legal issues, a good synopsis can be found at the Mark Levin Radio Show podcast for February 18th. Mark is an attorney and his Landmark Legal Foundation has argued many cases before the Supreme Court. He can explain complex legal issues in straightforward language.